Contracts for prison and probation work in the UK are dominated by a few multinationals and large voluntary sector organisations, according to new research by the Centre for Crime and Justice Studies.

The research, published in the third edition of UK Justice Policy Review (UKJPR), is based on analysis of Ministry of Justice transparency data. Now in its third year, UKJPR, published annually by the Centre for Crime and Justice Studies, with the support of the Hadley Trust, tracks year-on-year developments in criminal justice and social welfare across the UK.

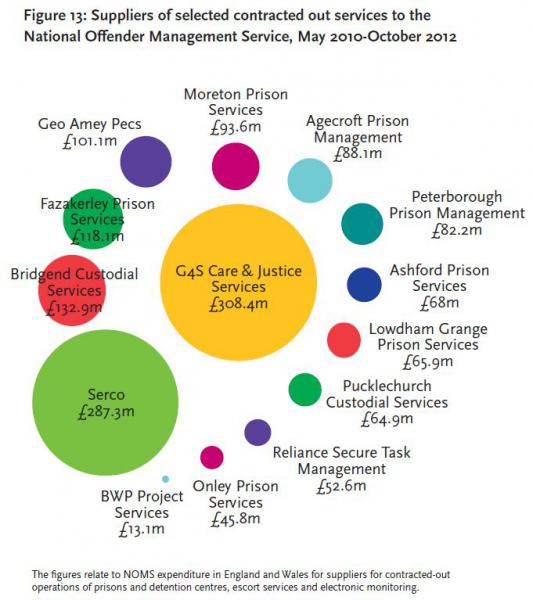

The figure to the left, showing the proportionate share of business of G4S, Serco and a further 12 smaller contractors, is taken from page 25 of UKJPR 3.

The figure to the left, showing the proportionate share of business of G4S, Serco and a further 12 smaller contractors, is taken from page 25 of UKJPR 3.

G4S and Serco, the two companies accused of overcharging on electronic monitoring contracts, were paid nearly £600 million by the National Offender Management Service (Noms) for prison and probation-related work between May 2010 and October 2012: some 40 per cent of the £1.5 billion spent by Noms during this period.

The figure reflects contract information as presented in the National Offender Management Service transparency data series. Many of the smaller organisations in the figure above are, however, associated with G4S, Serco and Sodexo, rather than being independent companies.

Brigdend Custodial Services, Fazakerley Prison Services and Onley Prison Services run HMPs Parc, Altcourse and Rye Hill respectively. They are part of the G4S network of companies.

Moreton Prison Services, Lowdham Grange Prison Services, Pucklechurch Custodial Services and BWP Project Services are responsible for, in order, HMPs Dovegate, Lowdham Grange, Ashfield and Thameside. All are part of the Serco empire.

Agecroft Prison Management, Ashford Prison Services and Peterborough Prison Management are part of Sodexo and run HMP/YOI Forest Bank, HMP Bronzefield and HMP Peterborough.

Once we unpick this complex network of companies, the G4S and Serco stranglehold on the market is even more apparent: accounting for three quarters of the contracting pie. Sodexo comes in a distant third, with 16 percent of contract value.

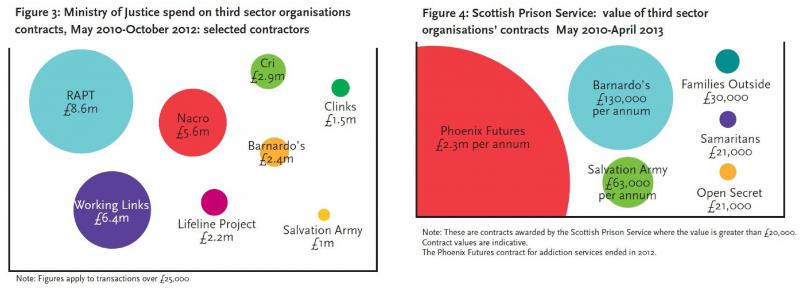

A small group of organisations also dominated the marketplace for third sector providers. In England and Wales Rapt, Working Links and Nacro shared two thirds of the £53.7 million spent by the Ministry of Justice on third sector contracts between May 2010 and October 2012.

The Ministry of Justice has declined to publish data covering the period since October 2012, despite a Freedom of Information request by the Centre for Crime and Justice Studies.

In Scotland, contracts with the prison service have been dominated by one main voluntary sector provider: Phoenix Futures. In Northern Ireland the relatively small pot of money for third sector contracts - £4.9 million – appears to have been spread more evenly.

The two figures below, from pages 20 and 21 of UKJPR 3, illustrate the proportionate share of the main third sector organisations in England, Wales and Scotland.

The third edition of UKJPR also includes an overview of developments in policing, courts and legal aid, prisons and probation, and welfare reform during the coalition government’s third year in power. Data sections cover the role of the third sector in criminal justice outsourcing; criminal justice expenditure; criminal justice staffing; the numbers of people processed; and key data on social welfare.

Other findings in UKJPR 3 include:

- Spending on law and order across the UK fell, continuing a trend identified in previous editions. In 2012/13 the UK spent £31.5 billion on public order and safety, a reduction of 15 per cent over five years.

- The criminal justice system continued to shrink across the United Kingdom. Police, prison and probation staff decreased in number. Fewer crimes were reported, fewer people were prosecuted and punished. Numbers in prison stabilised, but did not fall.

- Regional differences across the United Kingdom, highlighted in previous editions of UKJPR, became more apparent. Scotland continued to diverge from the rest of the United Kingdom, with increases in police, prison and probation staff and more people serving community sentences.

Richard Garside, Director of the Centre for Crime and Justice Studies and one of the report authors said:

Despite the government’s expressed commitment to creating a diverse marketplace for criminal justice services, it is currently dominated by a couple of multinational security companies with tarnished reputations and a few large national charities.

As the government continues to press ahead with plans to privatise the probation service this only adds to concerns that there are simply not enough credible and experienced organisations out there that can competently undertake the complex work involved.

Now in its third year, UK Justice Policy Review has established itself as the key go to publication for those looking for an accessible overview of criminal justice and social welfare developments across the United Kingdom.

Related items

The great criminal justice contracts monopoly (17 March, 2014)

UK Justice Policy Review: Volume 3 (17 March, 2014)

UK Justice Policy Review: Volume 2 (11 March, 2013)

UK Justice Policy Review: Volume 1 (26 November, 2012)